It took just three years and four months for the government's online registration platform for MSMEs to reach 3 crore registrations. Maharashtra led the state-based registration table with over 35 lakh enterprises. Maharashtra was followed by Tamil Nadu (20.5 lakh), Uttar Pradesh (19.13 lakh), Gujarat (14.87 lakh), and Rajasthan (14.84 lakh) as the top five states by number of registered companies.

The majority of the enterprises registered on the platform are micro-enterprises, comprising 2.93 crores of the total 3 crore enterprises on the platform. On the platform, there were 5.78 lakh small enterprises and 53,935 medium enterprises. They employed 14.87 crore people in total, including 3.37 crore women.

Udyam's GST-registered MSMEs represented 53.41 lakh manufacturing units and 1.49 crore service providers. Of these, 1.92 lakh are exporting enterprises, and cumulatively exported goods and services worth over Rs 15 lakh crore.

The Indian government has taken various measures to support and promote the growth of MSMEs in the country, including the introduction of MSME registration. MSME registration is a process through which small businesses can obtain various benefits from the government, such as access to credit, subsidies, and other incentives. The registration is voluntary, and any business that meets the eligibility criteria can apply for it. The registration process is straightforward and can be done online through the Udyog Aadhaar portal.

In this article, we will delve into the details of MSME registration in India, including the eligibility criteria, the benefits of registration, and the registration process. We will also discuss the challenges faced by MSMEs in India and the government's efforts to address them.

Understanding MSME

MSME stands for Micro, Small, and Medium Enterprises. These enterprises play a vital role in the Indian economy, contributing to its growth and development. MSMEs are involved in manufacturing, processing, packaging, and service-oriented activities. They are the backbone of the Indian economy, contributing to its GDP and providing employment opportunities to millions of people.

In India, MSMEs are classified based on their investment in plant and machinery or equipment. The classification is as follows:

- Micro Enterprises: Investment up to Rs. 1 crore

- Small Enterprises: Investment up to Rs. 10 crore

- Medium Enterprises: Investment up to Rs. 50 crore

MSMEs can register themselves with the government to avail various benefits and schemes. The registration process is simple and can be done online. Once registered, MSMEs can avail benefits such as credit guarantee, subsidies, and tax exemptions. The government has also introduced various schemes to support MSMEs such as the Prime Minister's Employment Generation Programme (PMEGP), Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), and the National Small Industries Corporation (NSIC).

Get Free Quote in Minutes

MSME Registration Process

MSME registration in India is a simple and straightforward process that can be completed online at free of cost. The registration process is governed by the Ministry of Micro, Small and Medium Enterprises and is aimed at providing various benefits to small and medium-sized businesses.

To register for MSME, the applicant needs to visit the official website of the Ministry of MSME and fill out the registration form. The form requires basic information about the business, such as the name of the company, its address, and the type of business activity. The applicant also needs to provide details about the ownership of the business, such as the name of the owner, the type of ownership, and the number of employees.

Once the registration form is submitted, the applicant will receive an MSME certificate, which can be used to avail various benefits provided by the government. The certificate contains important details about the business, such as its name, address, and the type of business activity. One of the main benefits of MSME registration is that it enables businesses to avail various government schemes and subsidies. For instance, businesses registered under MSME are eligible for various tax exemptions and incentives. They can also avail low-interest loans and subsidies for various business activities. Additionally, MSME registration also provides businesses with access to various government tenders and contracts.

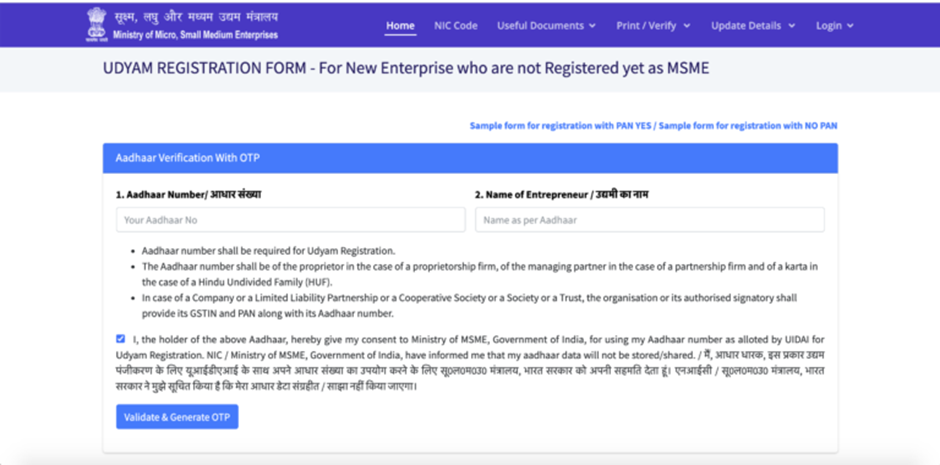

1. To register, go to the Udyam registration portal.

2. Click on the first link on the page if you are registering your business for MSME first time.

3. Click on 'Validate & Generate OTP' once you have entered your Aadhaar Number and Name.

4. After verification, you must enter your PAN details. If you do not yet have a PAN card, you can select the No option.

5. Afterwards, you must fill out the form with fields 5-24.

6. You will receive an OTP request at the end of the form. Enter the OTP and verification code to submit the form.

7. Keep your Registration Number handy for future reference after successfully registering. After successful registration, a "Thank You" message will appear with a Registration Number.

8. Upon submitting the application form, the approval and registration process can take two or three days.

9. Upon approval, the registration will be completed and your MSME certificate will be sent via email.

What are the advantages of MSME registration?

MSME Registration in India offers several benefits to the registered entities. Here are some of the key advantages of getting MSME Registration:

1. No expiry –

Udyam/MSME Registration Certificates do not expire as long as the entity is ethical and financially healthy.

2. Access to Government Schemes and Incentives

MSMEs registered under the MSMED Act, 2006 can avail various schemes and incentives offered by the Government of India. These include credit guarantee scheme, subsidies, and other financial assistance schemes. Additionally, registered MSMEs can also participate in various trade fairs and exhibitions organized by the government.

3. Priority Lending by Banks

Banks and financial institutions in India offer priority lending to MSMEs, which means that they are given preference while sanctioning loans. MSME Registration is necessary to avail this benefit.

4. Protection against Delayed Payments

The MSMED Act, 2006 provides protection to MSMEs against delayed payments from buyers. Registered MSMEs can file a complaint with the concerned authority in case of delayed payments and seek redressal.

5. Access to Tendering Opportunities

MSMEs registered under the MSMED Act, 2006 are eligible to participate in government tenders, which can be a significant source of business for small and medium-sized enterprises.

6. Tax Benefits

MSMEs can avail various tax benefits such as exemption from certain taxes, capital gains tax exemption, and other benefits under the Income Tax Act, 1961. Additionally, GST exemption limit for MSMEs has been increased from Rs. 20 lakhs to Rs. 40 lakhs, which means that small businesses with a turnover of up to Rs. 40 lakhs are exempted from GST registration.

7. Brand Building and Credibility

MSME Registration can help in building a brand and establishing credibility in the market. It can also help in attracting customers and investors.

8. Registration subsidy for patents

According to existing regulations, MSMEs registered with the MSME ministry are eligible for a significant discount on patent registration costs. A subsidy can be applied for by applying to the relevant ministries. This motivates startups and small companies to continue developing innovative ideas and technologies.

What is the eligibility criteria for MSME registration?

To register as an MSME in India, the entity must meet certain eligibility criteria. The eligibility criteria for MSME registration in India are as follows:

Manufacturing Enterprises

Manufacturing enterprises are those that are involved in the production or manufacture of goods. To be eligible for MSME registration, a manufacturing enterprise must have an investment of less than Rs. 50 crore in plant and machinery.

Service Enterprises

Service enterprises are those that are involved in the provision of services. To be eligible for MSME registration, a service enterprise must have an investment of less than Rs. 10 crore in plant and machinery.

Micro Enterprises

Micro enterprises are those that have an investment of up to Rs. 1 crore in plant and machinery or equipment. To be eligible for MSME registration as a micro enterprise, the entity must have a turnover of up to Rs. 5 crore.

Small Enterprises

Small enterprises are those that have an investment of up to Rs. 10 crore in plant and machinery or equipment. To be eligible for MSME registration as a small enterprise, the entity must have a turnover of up to Rs. 50 crore.

Medium Enterprises

Medium enterprises are those that have an investment of up to Rs. 50 crore in plant and machinery or equipment. To be eligible for MSME registration as a medium enterprise, the entity must have a turnover of up to Rs. 250 crore.

It is important to note that the eligibility criteria for MSME registration in India may change from time to time. Therefore, it is advisable to check the latest eligibility criteria before applying for MSME registration.

What are the documents required for MSME registration?

To register a business as an MSME in India, certain documents need to be submitted. These documents serve as proof of identity, address, business entity, and bank details. Here are the documents required for MSME registration:

Identity Proof

The following documents can be submitted as proof of identity:

- Aadhaar Card

- Voter ID Card

- Passport

- Driving License

- PAN Card

Address Proof

The following documents can be submitted as proof of address:

- Aadhaar Card

- Voter ID Card

- Passport

- Driving License

- Utility Bills (Electricity, Water, Gas, Telephone, etc.)

Business Entity Proof

The following documents can be submitted as proof of business entity:

- Partnership Deed (for partnership firms)

- Certificate of Incorporation (for companies)

- Memorandum of Association (for companies)

- Articles of Association (for companies)

- GST Registration Certificate (if applicable)

Bank Details

The following documents can be submitted as proof of bank details:

- Bank Statement

- Cancelled Cheque

It is important to note that the documents required for MSME registration may vary depending on the type of business entity and the state in which it is registered. It is recommended to consult with a professional or visit the official MSME website for specific requirements.

By providing the necessary documents, businesses can successfully register as an MSME in India and avail of the various benefits and schemes offered by the government.

What are the common mistakes to avoid while registering for MSME/Udyam?

When registering for MSME in India, there are some common mistakes that entrepreneurs should avoid. Here are some of the most important ones:

1. Not Checking Eligibility Criteria

Before applying for MSME registration, it is essential to check whether the business meets the eligibility criteria. The eligibility criteria differ based on the type of entity, and failing to check them can lead to rejection of the application.

2. Providing Incorrect Information

Providing incorrect information in the application can lead to rejection of the application or cancellation of the registration. It is crucial to provide accurate information, including the business name, address, and contact information.

3. Not Providing Adequate Supporting Documents

Supporting documents are essential for MSME registration, and not providing adequate documents can lead to rejection of the application. It is essential to provide all the required documents, such as PAN card, Aadhaar card, and bank statement, among others.

4. Choosing the Wrong Registration Type

There are different types of MSME registration, such as Udyog Aadhaar, MSME registration, and Udyam registration. Choosing the wrong type of registration can lead to complications, and it is essential to choose the appropriate type based on the business's size and turnover.

5. Not Following the Procedure

The MSME registration process involves several steps, and it is essential to follow the procedure correctly. Not following the procedure can lead to delays in the registration process or even rejection of the application.

In conclusion, entrepreneurs should avoid these common mistakes while registering for MSME in India to ensure a smooth and hassle-free registration process.

Do we need to renew the MSME certificate?

MSME registration in India is valid for a lifetime, but renewal is required for some specific cases. If the MSME obtains a new plant or machinery, it is necessary to update the registration certificate by applying for renewal. The renewal application must be submitted within six months of the installation of the new plant or machinery.

How are MSME and Udyam Registrations different?

The Udyam registration process is an alternative to Udyog Aadhaar that allows MSMEs to register on the government's portal more easily, thereby saving them time and effort. A hassle-free registration process, Udyam lets anyone register immediately through a single window without requiring extensive documentation. Previously, registration involved numerous categories and documents which required extensive paperwork.

Who can apply for Udyam registration?

Those in the manufacturing, service, wholesale, and retail industries that meet the revised MSME classification criteria of annual turnover and investment may apply for MSME registration. Thus, the eligibility for MSME registration depends on the annual turnover and investment of an entity. Eligible entities for MSME registration include:

· Sole proprietors, business owners, small businesses

· Private, partnership and public limited entities

· Self-help groups

· Cooperative societies

· Trusts

Conclusion

It is important for businesses to comply with the regulations and guidelines set forth by the government to avoid any legal complications. MSME registration is a valuable step for any business looking to expand and benefit from government initiatives. By registering and complying with regulations, businesses can access a range of benefits and opportunities that can help them thrive in the competitive market.

Frequently Asked Questions

1. What is the best way to check MSME status by name?

The PAN number or GST number can be used to determine whether a business is registered as an MSME. The business name can also be used to determine its status.

2. What all businesses may come under MSME?

Retail trade business, engineering & fabrication, leather, natural fragrance, HR consultancy, educational institute, furniture, stationery, printing, pharmaceutical, energy efficient pumps, parlour, para medical clinics, equipment rental firm, automotive, electronic surveillance, khadi products, poultry farming, call centre, rubber products, wholesale businesses to name a few.

3. Which all businesses are usually exempted from MSME registration?

Gambling, fishing, betting, repair of motorcycles, domestic personnel, goods for personal use, and activities of extraterritorial bodies.

4. What is NIC in MSME registration?

The National Industrial Classification Code (NIC) is a two-to-three-digit code used to register Udyog Aadhaar. It can be a two-to-three-digit number. In addition to the two-to-three-digit code that represents a group of business activities, there are four-digit codes that represent classes of business activities, while five digit codes represent subclasses of business activities.

Customized Insurance for Businesses