Insurance, a cornerstone of financial security, serves as a protective shield against unforeseen perils. It’s a mechanism that pools risks together, allowing individuals to transfer the financial burden of potential losses to a larger group. However, navigating the complex world of insurance can be a daunting task. But, having a profound understanding of the principles of insurance can make this task a whole lot easier. It will also help policyholders in making informed decisions about coverage. In this article, we will look into the 7 fundamental principles that govern insurance contracts.

What are the Principles of Insurance?

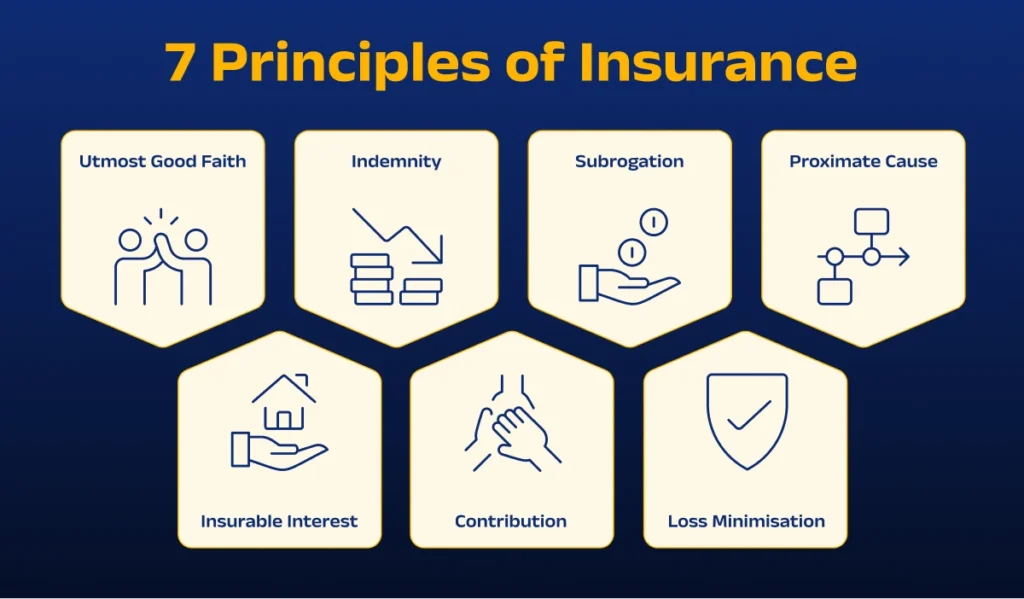

The principles of insurance include seven key concepts: insurable interest, utmost good faith, proximate cause, indemnity, subrogation, contribution, and loss minimisation. These principles guide how insurance contracts are formed, interpreted, and enforced to ensure fairness, legality, and risk-sharing between insurer and policyholder.

Understanding Principles of Insurance

Understanding the principles of insurance is important for both insurers and insureds, as they help to ensure that insurance policies are fair and effective. By following these principles, insurers can provide financial protection to their clients, while insureds can have confidence that they will be compensated in the event of a loss or damage.

The seven Principles of Insurance are:

1. Principle of Utmost Good Faith

The principle of utmost good faith is one of the fundamental principles of insurance. It requires both the insurer and the insured to act in good faith and disclose all material facts that could influence the decision to insure or the terms of the insurance policy. This principle is based on the belief that insurance contracts are based on trust and mutual confidence between the insurer and the insured. If either party fails to disclose material facts, it could lead to an unfair advantage for one party over the other.

The principle of utmost good faith applies to all types of insurance contracts, including life insurance, health insurance, property insurance, and liability insurance. It is the responsibility of both the insurer and the insured to ensure that all material facts are disclosed at the time of the contract. Material facts are those that could influence the decision to insure or the terms of the insurance policy. For example, if an insured person has a pre-existing medical condition, it is their responsibility to disclose this to the insurer. Failure to do so could lead to the insurer denying a claim in the future.

In addition to the duty to disclose material facts, the principle of utmost good faith also requires both parties to act with honesty and fairness throughout the insurance contract. This means that the insurer must act in good faith when assessing claims, and the insured must act in good faith when providing information to the insurer.

The principle of utmost good faith is an essential principle in insurance. It ensures that insurance contracts are based on trust and mutual confidence between the insurer and the insured. By disclosing all material facts and acting with honesty and fairness, both parties can ensure that the insurance contract is valid and enforceable.

2. Principle of Insurable Interest

Insurable interest refers to the legal right of an individual to insure a particular item or person. It is a fundamental principle of insurance that ensures that the policyholder has a financial interest in the property or person being insured. This principle is essential because it prevents individuals from taking out insurance policies on items or people that they do not have a financial interest in.

In the case of property insurance, the policyholder must have an insurable interest in the property being insured. For example, a homeowner has an insurable interest in their home because they have a financial stake in the property. If the property is damaged or destroyed, the homeowner will suffer a financial loss. Therefore, they have the right to insure the property to protect themselves from financial loss.

Similarly, in the case of life insurance, the policyholder must have an insurable interest in the person being insured. This means that the policyholder must have a financial interest in the life of the insured. For example, a person can take out a life insurance policy on their spouse, as they would suffer a financial loss if their spouse were to pass away.

The principle of insurable interest is essential because it ensures that insurance policies are not taken out for speculative purposes. It prevents individuals from taking out insurance policies on items or people that they do not have a financial interest in. This helps to prevent fraud and abuse of the insurance system.

3. Principle of Indemnity

The principle of indemnity is a fundamental principle of insurance that aims to compensate the insured for the actual loss suffered, without providing any financial gain. It is based on the principle that insurance is a means of restoring the insured to the same financial position they were in before the loss occurred.

In simpler terms, indemnity means that the insured is entitled to receive compensation for the actual loss suffered, but not more than the amount of the loss. This principle applies to most types of insurance policies, including property, liability, and motor insurance.

For example, if a car is insured for Rs 3,00,000 and is damaged in an accident, the insurer will compensate the insured for the actual cost of repairs, up to the limit of the policy. If the cost of repairs is less than the insured amount, the insurer will only pay the actual cost of repairs. If the cost of repairs is more than the insured amount, the insurer will only pay up to the limit of the policy.

The principle of indemnity helps prevent moral hazard, which is the tendency for people to take risks because they are insured. It ensures that the insured does not profit from the loss and that the insurer does not suffer any loss.

In some cases, the principle of indemnity may not apply. For example, life insurance policies do not follow the principle of indemnity because the loss is not financial, but rather the loss of life. In such cases, the insurer pays the sum assured to the nominee of the insured.

4. Principle of Subrogation

The principle of subrogation is an essential principle of insurance that allows an insurer to assume the rights of the insured after paying a claim. In other words, it gives the insurer the right to pursue a third party that caused the loss to the insured. The insurer can do this by taking legal action against the third party to recover the amount paid to the insured.

The principle of subrogation is based on the idea that an insured should not be paid twice for the same loss. If a third party is responsible for the loss, the insurer has the right to recover the amount paid to the insured from the third party. This principle is particularly relevant in cases where the insured has a liability policy.

For example, if a driver causes an accident that results in damage to another person’s car, the driver’s insurance company will pay for the damage. However, if the driver was not at fault, the insurance company can pursue the other driver’s insurance company to recover the amount paid to the insured.

The principle of subrogation is closely related to the principle of indemnity, which states that an insured should be compensated for the actual amount of the loss suffered. By allowing the insurer to recover the amount paid to the insured, the principle of subrogation helps to ensure that the insured is adequately compensated for their loss.

5. Principle of Contribution

The principle of contribution is a fundamental principle of insurance that states that an individual cannot claim more than the actual amount of loss suffered. In other words, if an individual has insured an asset for an amount that is greater than its actual value, they cannot claim the excess amount from the insurance company.

The principle of contribution applies when an individual has taken out more than one insurance policy for the same asset. In such cases, the individual is not allowed to claim the full amount of loss from both insurance companies. Instead, each insurance company will pay a proportionate amount of the loss, based on the sum insured by their policy.

For example, if an individual has insured their car for Rs 1,00,000 with two different insurance companies, and the car is involved in an accident that causes Rs 80,000 worth of damage, they cannot claim the full amount of Rs 80,000 from both insurance companies. Instead, each insurance company will pay a proportionate amount of the loss, based on the sum insured by their policy. If one insurance policy covers 60% of the car’s value and the other covers 40%, then the first insurance company will pay Rs 48,000 and the second insurance company will pay Rs 32,000.

The principle of contribution is designed to prevent individuals from profiting from an insurance claim. It ensures that an individual cannot recover more than the actual amount of loss suffered and that insurance companies are not required to pay more than their fair share of the loss.

6. Principle of Loss Minimisation

The principle of loss minimisation is an essential principle of insurance. It refers to the steps taken by the insured to minimise the loss or damage to the insured property. This principle is based on the premise that the insured has a responsibility to take reasonable and necessary steps to prevent or reduce the loss or damage to the insured property.

The principle of loss minimisation applies to all types of insurance policies, including property insurance, liability insurance, and life insurance. In property insurance, the insured is expected to take precautions to protect the insured property from damage or loss. For example, the insured may install fire alarms, sprinkler systems, and security devices to reduce the risk of fire or theft.

In liability insurance, the insured is expected to take measures to prevent accidents or injuries that could lead to claims against them. For example, a business owner may implement safety procedures and provide training to employees to reduce the risk of accidents.

In life insurance, the insured is expected to take measures to maintain good health and avoid risky behaviors that could lead to premature death. For example, a person may quit smoking, exercise regularly, and maintain a healthy diet to reduce the risk of developing chronic illnesses.

The principle of loss minimisation is also relevant in the claims process. If the insured fails to take reasonable steps to prevent or reduce the loss or damage to the insured property, the insurer may reduce the amount of the claim or deny it altogether.

7. Principle of Causa Proxima

The Principle of Causa Proxima, also known as the Proximate Cause Principle, is one of the seven principles of insurance. It states that the insurer will consider the cause of the loss or damage, and will only cover the loss if it is caused by an insured peril. In simpler terms, this principle means that the insurance company will only pay out for a claim if the proximate or nearest cause of the loss or damage is covered under the policy. This principle is important because it helps to determine whether a claim is valid or not, and helps to prevent fraudulent claims.

For example, if a person’s car is damaged in an accident, the insurance company will investigate the cause of the accident to determine if it is covered under the policy. If the accident was caused by a covered peril, such as collision or theft, then the insurance company will pay out for the damages. However, if the accident was caused by a non-covered peril, such as a natural disaster or intentional act, then the insurance company will not pay for the damages.

In some cases, the cause of the loss or damage may be difficult to determine. In these situations, the insurance company will use the principle of causa proxima to determine the nearest cause of the loss or damage. This may involve an investigation or consultation with experts to determine the cause of the loss or damage.

Conclusion

Understanding the 7 principles of insurance will help individuals make informed decisions and ensure that they are adequately protected in the event of a loss. These principles also ensure transparency, fairness, and accountability, fostering trust and confidence within the insurance industry. Whether seeking protection against life’s uncertainties or safeguarding valuable assets, understanding these fundamental tenets empowers individuals to make informed decisions and secure the financial peace of mind they deserve.

Frequently Asked Questions

- What are the fundamental principles of insurance?

The fundamental principles of insurance are based on the idea of risk management. Insurance is a contract between the insurer and the insured, where the insurer agrees to compensate the insured in case of a loss or damage. The fundamental principles of insurance are:

- Utmost good faith

- Insurable interest

- Indemnity

- Contribution

- Subrogation

- Loss minimisation

- Proximate cause

2. What happens if a principle is violated?

Violation of a principle can lead to disputes, claims denials, or invalidation of the insurance contract. Both parties must understand and adhere to these principles for a smooth and transparent insurance experience.

3. What is the principle of indemnity in insurance?

The principle of indemnity in insurance is the idea that the insured should be compensated for their losses, but not be put in a better financial position than they were in before the loss occurred. This means that the insured should be compensated for the actual value of the loss, rather than the full value of the insured item.