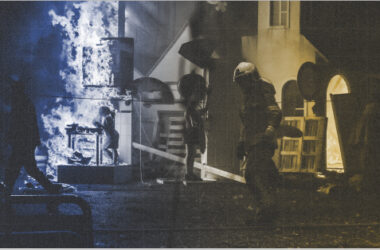

In the complex landscape of insurance policies, the fine print often holds the key and can make a substantial difference when it comes to coverage. One such intricacy that deserves our attention is the “Accidental Damage Clause” in Fire Insurance Policies. While Fire Insurance is designed to provide financial protection against the devastating impact of flames, understanding the specific terms and conditions, especially those related to accidental damage, is crucial for policyholders. In this article, we will have a closer look at the Accidental Damage Clause in Fire Insurance. Here, we will empower you with the knowledge needed to safeguard your interests in the event of accidental damage within the domain of Fire Insurance.

Understanding the Accidental Damage Clause in Fire Insurance

Accidental damage clause in Fire Insurance is an important aspect of Fire Insurance Policies. This clause provides coverage for damages that are caused unintentionally, such as when a fire breaks out due to faulty wiring or a cooking accident. However, intentional damage or damage caused by negligence may not be covered. The accidental damage clause is typically included in most Fire Insurance Policies, but it is important to review the policy carefully to ensure that it is included. In addition, it is important to understand the process for filing a claim under the accidental damage clause. This may include providing documentation of the damage, such as photographs or receipts for repairs. It is also important to report the damage to the insurance company as soon as possible to ensure that the claim is processed in a timely manner.

The clause typically defines the scope of accidental damage, specifying the types of incidents that qualify. Policyholders should carefully review and understand these definitions to ensure that they align with their expectations.

The accidental damage clause typically covers damages caused by events such as:

- Fire caused by electrical faults or appliances

- Water damage caused by burst pipes or overflowing baths

- Accidental breakage of glass or sanitary fixtures

- Damage caused by falling objects such as trees or aerials

- Damage caused by impact from vehicles or animals

- Damage caused by storms or floods

Importance of Accidental Damage Clause in Fire Insurance

Accidental damage clause in Fire Insurance is an essential aspect of any insurance policy. It provides coverage for any damage caused to the insured property by accident, which is not covered under the standard Fire Insurance Policy. Accidents can happen anytime, and they can cause significant damage to the property. Therefore, having an accidental damage clause in the Fire Insurance Policy can provide the necessary financial protection to the insured.

The accidental damage clause covers a wide range of damages that can occur due to accidents, such as damage caused by falling objects, water damage, damage caused by electrical short circuits, damage caused by explosions, and damage caused by natural calamities like earthquakes, floods, etc. Without this clause, the insured would have to bear the cost of repairing or replacing the damaged property, which can be a significant financial burden.

Having an accidental damage clause in the Fire Insurance Policy can also provide peace of mind to the insured. They can be confident that they are protected against any unforeseen event that may cause damage to their property. This clause can also help the insured to avoid disputes with the insurance company regarding the coverage of damages caused by accidents.

Limitations of Accidental Damage Clause

While the accidental damage clause in Fire Insurance Policies can provide coverage for various types of damages, it is important to note that there are certain limitations to this clause.

Negligence and Intentional Acts: Many Fire Insurance Policies exclude coverage for damage resulting from negligence or intentional acts by the policyholder. If the accidental damage is a consequence of actions deemed negligent or deliberate, the insurance company may deny the claim.

Excluded Perils: The policy may list perils that are not covered under the Accidental Damage Clause. For instance, damages caused by war, terrorism, or other specific events may be excluded. It is crucial to be aware of these exclusions to avoid surprises during the claims process.

Policy Sub-limits: Some policies impose sub-limits on the amount payable for accidental damage. These sub-limits could apply to specific types of property or circumstances, potentially capping the reimbursement amount regardless of the actual loss suffered.

Notification and Reporting Timelines: Insurance policies often have stringent requirements regarding the timely reporting of damages. Failure to promptly notify the insurer about accidental damage may result in claim denial. Policyholders should be familiar with the notification and reporting procedures specified in their policies.

Wear and Tear: Accidental damage clauses may not cover damage resulting from wear and tear, gradual deterioration, or pre-existing conditions. It is crucial to distinguish between sudden, accidental damage and damage that occurs over time due to aging or lack of maintenance.

The Impact of Accidental Damage Clause on Premiums

The accidental damage clause in Fire Insurance can have a significant impact on the premiums that policyholders pay. Including this clause in a Fire Insurance Policy can increase the premiums, as it increases the risk of the insurer having to pay out for accidental damage. However, the exact impact on premiums will depend on several factors, including the level of cover provided by the policy, the value of the insured property, and the policyholder’s claims history.

Policyholders who opt for a higher level of cover that includes accidental damage will generally pay higher premiums than those who choose a lower level of cover without this clause. Similarly, those who insure high-value properties will likely pay more for accidental damage cover than those who insure lower-value properties.

Insurers may also take into account the policyholder’s claims history when calculating premiums. If the policyholder has made previous claims for accidental damage, they may be seen as a higher risk and charged higher premiums.

It is important for policyholders to carefully consider whether they require accidental damage coverage and to compare policies from different insurers to ensure they are getting the best value for money. They should also ensure they fully understand the terms and conditions of their policy, including any excesses that may apply to accidental damage claims.

Conclusion

As we draw the curtains on our journey on the “Accidental Damage Clause” in Fire Insurance, it is evident that understanding the fine print of this clause is not merely a matter of due diligence but a proactive step toward securing comprehensive protection. This clause serves as a beacon of relief, extending coverage beyond the flames to shield policyholders from the unforeseen and accidental. However, as we have uncovered, this safeguard comes with its own set of limitations and intricacies. From the scope of covered incidents to the exclusions that may apply, each facet demands our attention and comprehension.

The Accidental Damage Clause is not a mere technicality but a lifeline for those navigating the unpredictable waters of property protection. By demystifying its complexities, we have endeavored to equip you with the tools to navigate your insurance landscape with confidence. May this understanding serve as a compass, guiding you through the fine print and ensuring that your safety net remains resilient in the face of the unforeseen.

Frequently Asked Questions

- What are some common add-on covers available under Fire Insurance Policies?

Fire Insurance Policies often offer add-on covers to provide additional protection to policyholders. Some common add-on covers available under Fire Insurance Policies include:

- Earthquake cover

- Terrorism cover

- Flood cover

- Riot and strike cover

- Impact damage cover

- Burglary and theft cover

2. What are the key clauses to look for in a Fire Insurance Policy?

When reviewing a Fire Insurance Policy, it is important to look for the following key clauses:

- Accidental damage clause

- Exclusions clause

- Deductible clause

- Reinstatement value clause

- STFI clause

3. How does the STFI clause in Fire Insurance Policies work?

The STFI (Standard Fire and Special Perils) clause in Fire Insurance Policies covers damage caused by fire, lightning, explosion, and other perils. This clause is usually included in all Fire Insurance Policies.