In the digital age, businesses face a growing array of cybersecurity challenges. While external cyberattacks such as phishing, malware, and ransomware dominate the headlines, a less obvious and often more dangerous threat looms from within the organisation: insider threats. These threats can be equally, if not more, devastating than external ones due to the inherent access that insiders—employees, contractors, or trusted third parties—have to sensitive data and critical systems. As India’s digital landscape evolves, understanding insider threats and the importance of Cyber Insurance in mitigating their risks is crucial.

In this blog, we will explore the nature of insider threats, their rising prominence in India, the consequences they can have on businesses, and how Cyber Insurance plays a pivotal role in protecting organisations from such risks.

What Are Insider Threats?

An insider threat refers to a security risk that originates from within the organisation. Unlike external attacks, which often originate from cybercriminals or hackers outside the organisation, insider threats involve individuals who have inside access to the company’s networks, systems, or data. These insiders can be current employees, contractors, business partners, or even former employees with retained access.

Insider threats can be broadly categorised into two types:

1. Malicious Insiders

Malicious insiders intentionally exploit their access to cause harm to the organisation. Their motivations can vary:

- Personal Gain: A disgruntled employee might steal intellectual property, trade secrets, or financial data for personal benefit or to sell it on the black market.

- Espionage: Employees might be coerced by competitors or hostile entities to leak sensitive information or sabotage business operations.

- Revenge: Discontented employees may seek to cause damage as a form of retaliation for perceived mistreatment, job loss, or disagreements within the company.

2. Negligent Insiders

Negligent insiders, on the other hand, cause security breaches not out of malicious intent but due to carelessness, lack of awareness, or inadequate training. Examples include:

- Phishing Scams: Employees clicking on malicious links or opening infected email attachments that lead to data breaches or malware infections.

- Weak Passwords: Insiders who fail to follow good password hygiene practices, such as using easily guessable passwords or sharing credentials.

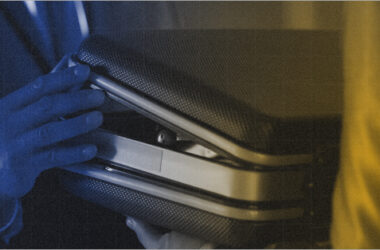

- Improper Device Usage: Employees using insecure devices, such as personal smartphones, for work, which can inadvertently expose the network to cyberattacks.

Both types of insider threats can lead to significant damage, making it crucial for businesses to understand, detect, and mitigate them effectively.

Why Insider Threats Are a Growing Concern in India

As India’s economy continues to grow and its businesses rapidly embrace digitalisation, the risk of insider threats has never been higher. The increasing complexity of business operations, coupled with the growing adoption of cloud technology and remote work, has made insider threats even more difficult to detect and prevent.

Here are some specific reasons why insider threats are becoming a critical issue for businesses in India:

1. Increasing Digital Transformation

India is witnessing an acceleration in the adoption of digital technologies across industries such as banking, e-commerce, healthcare, and manufacturing. The shift to cloud computing, enterprise resource planning (ERP) systems, and digital payment systems has opened new channels for insiders to exploit their access.

In recent years, India has experienced a noticeable uptick in data breaches, many of which involved insider negligence or misuse. As digital adoption grows, so does the opportunity for insiders to misuse or accidentally expose sensitive information.

2. Surge in Remote Work

The COVID-19 pandemic forced businesses across India to adopt remote work arrangements. While this model has proven to be efficient for many, it has also created cybersecurity gaps. Insiders working remotely might access sensitive company data from less-secure devices or networks, increasing the risk of data leaks or breaches.

According to surveys, a significant proportion of Indian business leaders have expressed concern over the security challenges associated with a remote workforce, citing issues like unsecured devices and poor visibility into user activity.

3. Third-Party Vendors and Contractors

Indian companies often rely on third-party vendors, suppliers, and contractors for a range of services. These external partners often have access to sensitive business data. A trusted vendor, if compromised or negligent, can inadvertently expose the organisation to cyber threats.

Vulnerabilities in third-party systems are increasingly being exploited, making supply chain and vendor risk management a top priority for Indian organisations.

4. Skill Gaps in Cybersecurity Awareness

Despite the growing number of cybersecurity threats, many Indian businesses still lack the necessary training and awareness among employees. A considerable number of Indian employees admit to falling victim to phishing scams and other preventable cyber incidents. Negligent insiders, who inadvertently contribute to a breach, are a growing concern.

The Impact of Insider Threats on Businesses

Insider threats can result in far-reaching consequences, far beyond the immediate financial loss. Here are some of the major impacts:

1. Financial Losses

The direct financial impact of insider threats can be staggering. According to IBM’s 2023 Cost of a Data Breach Report, the average cost of a data breach in India was around INR 17.9 crores (~USD 2.2 million), with insider threats contributing significantly due to the complexity of investigating and recovering from a breach.

2. Reputational Damage

The reputational damage caused by an insider attack can be long-lasting. Customers, partners, and investors may lose confidence in the company’s ability to protect sensitive information. With India’s growing digital economy, businesses that face data breaches are more likely to suffer from lost business opportunities, reduced trust, and even legal consequences.

3. Operational Disruptions

Insider threats can severely disrupt day-to-day operations. A malicious insider may sabotage critical systems or steal intellectual property, which can delay product launches or disrupt services. Indian cybersecurity reports have noted an increase in disruptive attacks targeting key sectors. While not all are directly attributed to insiders, internal actors can often facilitate or worsen such breaches.

4. Legal and Compliance Risks

India has strengthened its data protection framework through the Digital Personal Data Protection (DPDP) Act, 2023, which is currently being implemented. The Act imposes strict obligations on businesses to protect personal data, and breaches—including those caused by insiders—can lead to substantial penalties. Organisations may face regulatory scrutiny and legal liability if found negligent in safeguarding sensitive information.

How Cyber Insurance Helps Mitigate Insider Threats

In response to the growing risks posed by insider threats, more businesses are turning to Cyber Insurance to protect themselves. Cyber Insurance provides a safety net that helps organisations manage the financial, legal, and operational impact of cybersecurity incidents, including insider threats.

1. Coverage for Financial Losses

Cyber Insurance policies can cover a wide range of expenses incurred due to insider threats, such as:

- Data Recovery: Insurance can cover the costs associated with restoring compromised data and repairing damaged systems.

- Legal Expenses: In the event of a breach, the legal costs for defending against lawsuits and regulatory penalties are often covered by cyber insurance.

- Ransom Payments: In some cases, if an insider threat leads to data being held hostage, the insurance policy may cover ransom payments (subject to policy terms).

2. Crisis Management and Reputation Protection

The reputational impact of an insider attack can be devastating. Cyber Insurance policies often include crisis management services, including:

- Public Relations Support: Insurers may provide access to PR firms that help manage the media narrative and protect the company’s brand.

- Customer Notifications: Cyber Insurance helps businesses notify affected customers, partners, and stakeholders in accordance with data protection regulations, ensuring that the process is managed effectively.

3. Business Interruption Coverage

A cyber attack—whether from an insider or an external hacker—can halt business operations, resulting in financial losses. Cyber Insurance policies often provide business interruption coverage, which helps compensate for revenue lost due to system downtime.

4. Legal and Regulatory Protection

With India’s increasing focus on data protection, regulatory fines are a real concern for businesses. Cyber Insurance provides protection against these risks, covering the costs associated with legal proceedings, regulatory fines, and penalties.

5. Employee Training and Awareness Programmes

Some Cyber Insurance providers offer support in reducing the risk of insider threats by providing funds for employee cybersecurity training. This helps prevent accidental breaches caused by negligent insiders and fosters a more cybersecurity-conscious workforce.

Choosing the Right Cyber Insurance Policy in India

When choosing a Cyber Insurance Policy in India, businesses need to consider several factors to ensure adequate protection against insider threats:

- Assessing Risk: Understand your organisation’s specific vulnerabilities—how much sensitive data you handle, the level of access granted to employees, and the potential impact of a breach.

- Evaluating Coverage: Ensure the policy covers a wide range of risks, including financial losses, legal liabilities, crisis management, and business interruption.

- Choosing the Right Insurer: Look for insurers with experience in cybersecurity and a strong track record in handling insider threat claims.

Final Thoughts:

Insider threats are a growing concern for businesses in India, with the potential to cause significant financial, operational, and reputational damage. As the country’s digital infrastructure expands, protecting against these internal risks becomes increasingly essential. With the implementation of the Digital Personal Data Protection Act, regulatory expectations are rising—and failure to prevent insider-led breaches could lead to severe consequences.

Cyber Insurance offers a robust safety net. It helps organisations manage the fallout from insider threats by covering financial losses, legal exposure, operational disruptions, and reputational damage. Importantly, many insurers also support proactive measures such as employee training and awareness programmes.

By investing in a well-structured Cyber Insurance Policy and implementing strong internal security controls, businesses in India can stay resilient in the face of insider-driven cyber risks.