A burglary is a type of theft that involves breaking into a property with the intention of stealing something. Burglaries can occur at any time, and they can be devastating for homeowners, renters, and businesses. The feeling of being burgled is not only emotionally distressing but can also lead to financial losses that can be difficult to recover from. This is where Burglary Insurance comes in. In this article, we will explore what Burglary Insurance is, what it covers, and why individuals and businesses need to consider obtaining it.

Let’s start with the basics then!

What is the Meaning of Burglary Insurance?

Burglary insurance covers loss or damage to property caused by forced entry or exit during a break-in. This insurance typically includes stolen valuables, damaged assets, and sometimes cash, depending on policy terms. It offers financial protection specifically against theft involving visible signs of intrusion.

Burglary Insurance Policies can be broadly classified into the following three types-

- Full Value Insurance

This type of burglary insurance policy covers the entire worth of the insured property.

- First Loss Insurance

When there is a low probability of a total loss, first-loss insurance allows the policyholder to choose a percentage of the assets to be insured.

- Stock Declaration Insurance

This policy is advantageous when a big number of stocks fluctuate regularly within a fiscal year. Here, the sum assured is fixed at the maximum expected stock value by the policyholder.

What Does Burglary Insurance Policy Cover?

The coverage provided by burglary insurance varies depending on the policy and the insurance company. However, most Burglary Insurance Policies cover the following:

- Stolen Property

Burglary Insurance typically covers stolen properties by providing compensation to the policyholder for the value of the stolen items. The coverage amount will depend on the limits of the policy and the value of the stolen property.

Most Burglary Insurance Policies use one of two methods to calculate the value of the stolen property: actual cash value or replacement cost value. Actual cash value coverage will compensate the policyholder for the current value of the stolen property, taking into account depreciation. Replacement cost value coverage, on the other hand, will compensate the policyholder for the cost of replacing the stolen property with a new item of similar kind and quality, without taking into account depreciation.

- Property Damage

Burglary Insurance can cover property damage resulting from burglary, such as broken windows, damaged doors, or other types of damage to the property. Most burglary insurance policies cover property damage under a separate coverage limit, which is typically referred to as “dwelling coverage” or “building coverage.” This coverage is designed to provide financial protection for the structure of the property, including any damage resulting from a burglary.

To make a claim for property damage, the policyholder will need to provide documentation to support their claim, such as photos or repair estimates for the damaged property. The insurance company may also require an inspection of the property to assess the extent of the damage.

- Business Interruption

Burglary Insurance can cover business interruption resulting from a burglary, which refers to the lost income and expenses related to the interruption of business operations. This coverage may also include expenses related to relocating the business temporarily or permanently. This coverage is important for businesses that rely on their physical location or inventory to operate and generate revenue.

To make a claim for business interruption, the policyholder will typically need to provide documentation to support their claims, such as financial statements and records of lost revenue during the interruption period.

- Replacement Costs

Burglary Insurance compensates the policyholder for the full cost of replacing stolen or damaged property with a new item of similar kind and quality. Here, the policyholder is not limited to receiving only the actual cash value (which considers depreciation) of the stolen or damaged item. Instead, the policyholder receives compensation for the full cost of replacing the item with a new one of comparable quality and specifications. To determine the replacement cost value, the insurance company may require the policyholder to provide documentation such as receipts, invoices, or professional appraisals that establish the cost of the stolen or damaged items.

- Legal Fees

Burglary Insurance may provide coverage for legal fees associated with defending against a lawsuit resulting from a burglary. These expenses can include attorney fees, court costs, and other legal-related expenses. It’s important for policyholders to review their burglary insurance policy carefully to understand if legal fee coverage is included and any limitations or conditions associated with it. Some policies may have specific exclusions or restrictions on the types of legal expenses covered or the circumstances in which coverage applies.

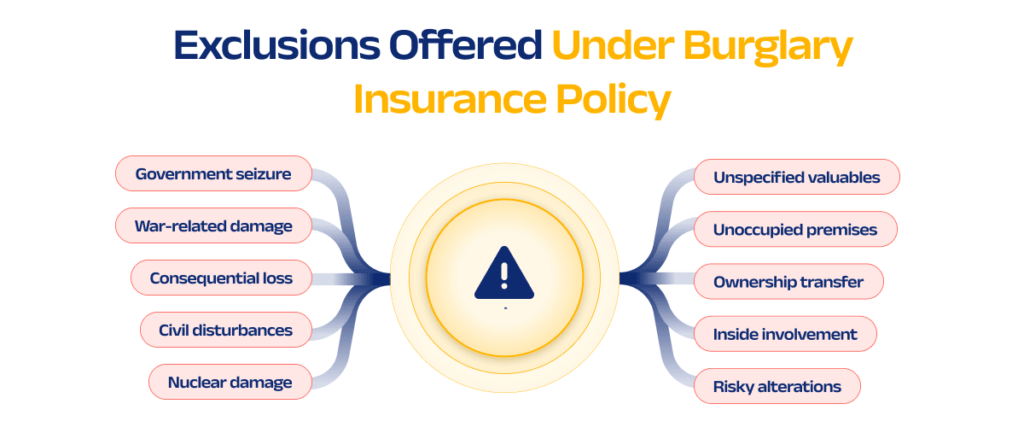

Exclusions Offered Under Burglary Insurance Policy

Here is a list of some of the common exclusions mentioned in a burglary insurance policy:

- Coverage for precious gems, jewellery, business books, cash, designs, plans, etc. unless specifically covered.

- Loss or Damage(s) where an insured or his staff/family member was involved in the actual theft

- When the property of the insured is left uninhabited for 7 or more days in a row.

- If material alterations are done to the premise that increases the risk.

- If the asset rights have been transferred to another individual(s) by the insured through a will or by operation of law.

- Damage(s) that result from a nuclear peril

- Damage(s) caused by war, a foreign enemy’s act, invasion, etc.

- Any damage(s) caused by nationalisation, seizure, etc by Government authorities

- Damages resulting from any sort of consequential loss.

- Damage(s) caused by riots, strikes, civil unrest, and so on.

Why is Burglary Insurance Policy Important for Businesses?

Burglary insurance is particularly important for businesses due to the unique risks they face when it comes to burglaries. Here are several reasons why burglary insurance is important for businesses:

- It provides Financial Protection- Burglaries can result in significant financial losses for businesses. Thieves may steal valuable equipment, inventory, cash, or sensitive information. Burglary insurance provides financial protection by covering the losses incurred due to stolen or damaged property, helping businesses recover and resume their operations in time.

- Covers Business Interruption Costs: A burglary can lead to business interruption, where the operations are temporarily halted or disrupted. This can result in lost income, ongoing expenses, and potential loss of customers. Burglary insurance with business interruption coverage can provide compensation for the income loss and necessary expenses during the interruption period, helping businesses stay afloat and recover financially.

- Compensates Property Damage: In addition to stolen property, burglaries often involve property damage such as broken windows, damaged doors, or vandalized premises. Burglary insurance can cover the costs of repairing or replacing the damaged property, saving businesses from the burden of expensive repairs.

- Helps in Rebuilding Trust: Burglaries not only cause financial losses but also damage a business’s reputation and customer trust. By having burglary insurance, businesses can demonstrate their commitment to safeguarding their assets and protecting their customers’ interests. This can help rebuild trust and confidence among clients, employees, and partners.

- Provides Liability Protection: In some cases, a burglary can lead to legal complications, such as claims of negligence or inadequate security measures. Burglary insurance may offer liability protection, covering legal fees and potential damages in the event of a lawsuit related to the burglary. This protection can be crucial in mitigating the financial impact of legal disputes and safeguarding the business’s reputation.

- Provides Customised Coverage: Burglary insurance policies can often be tailored to meet the specific needs of different types of businesses. Whether it’s a retail store, office space, restaurant, or warehouse, businesses can select coverage options that align with their unique risks and requirements. This flexibility allows businesses to create comprehensive insurance plans that adequately protect their assets and operations.

The footnote:

From the discussion above, we have seen how burglary insurance provides coverage for loss or damage to property resulting from a burglary. The coverage provided by burglary insurance varies depending on the policy and the insurance company. However, most burglary insurance policies cover the theft of personal property, property damage, business interruption, replacement costs, and legal fees.

Burglary insurance is important because burglaries can be financially devastating, and it can provide peace of mind knowing that you are protected against the financial impact of a burglary. For more information related to burglary insurance or on any topic related to insurance for that matter, you may contact BimaKavach. Here, you can also get the best recommendation for any insurance product in just 5 minutes.