Marine Insurance is a type of insurance coverage designed to protect ships, cargo, and other maritime interests against risks and perils encountered during marine voyages or transportation. Here are the key points about Marine Insurance:

- Coverage for Maritime Risks: Marine Insurance provides coverage for various risks encountered at sea, including damage to ships, cargo, and other maritime property, as well as liability risks arising from marine operations.

- Types of Marine Insurance Policies: There are different types of Marine Insurance policies tailored to specific maritime interests, including hull insurance for ships, cargo insurance for goods transported by sea, and liability insurance for shipowners, charterers, and maritime businesses.

- Protection Against Perils: Marine Insurance covers a wide range of perils, including damage or loss due to storms, collisions, piracy, theft, fire, sinking, grounding, and other maritime hazards.

- Comprehensive Coverage: Marine Insurance policies offer comprehensive coverage for both physical damage to vessels and cargo and financial losses resulting from maritime accidents, such as business interruption, salvage, general average, and sue and labor expenses.

- International Scope: Marine Insurance is essential for global trade and transportation, providing coverage for shipments and vessels traveling across international waters and through various maritime jurisdictions.

- Importance for Trade and Commerce: Marine Insurance facilitates trade and commerce by providing financial protection to cargo owners, exporters, importers, and shipping companies against the inherent risks of marine transportation.

- Legal and Regulatory Requirements: Marine Insurance may be required by international conventions, such as the Hague-Visby Rules or the Carriage of Goods by Sea Act, as well as by contractual agreements between parties involved in maritime transactions.

- Role of Marine Insurers: Marine Insurance is typically provided by specialized marine insurers, underwriters, and P&I clubs with expertise in assessing and managing maritime risks and claims.

- Customizable Coverage: Marine Insurance Policies can be tailored to meet the specific needs and requirements of maritime businesses, including coverage limits, deductibles, policy extensions, and additional endorsements.

Let’s start with the basics!

What is Marine Insurance? Meaning of Marine Insurance

Marine Insurance Policies are available to everyone who has an insurable interest as per Section 5 of the Marine Insurance Act 1906 (MIA). A marine policy covers loss or damage to cargo or goods during transportation from the point of origin to the point of destination. There are several types of Marine Insurance Policies, including those for road, rail, air, and sea transportation, as well as those for courier and postal services.

Fire, explosion, hijacks, accidents, collisions, and overturns are the most common causes of marine cargo loss during transit. In addition to covering theft, malicious damage, shortages, non-delivery of goods, damages during loading and unloading, and cargo mishandling, a Marine Insurance Policy may offer specially curated plans. Coverage can be customized depending on business requirements, and it is available for a wide variety of cargo/goods, whether you trade or manufacture them.

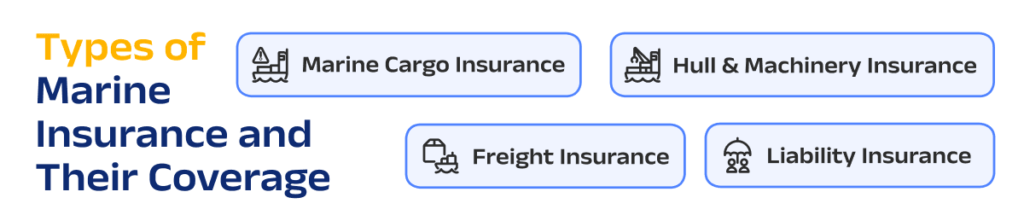

Types of Marine Insurance in India

Before purchasing Marine Insurance, you should be informed of the various types available so that you can select the one that suits your needs the most. Different types of Marine Insurance are as follows:

1. Marine cargo insurance

Cargo owners face the danger of cargo mishandling at the terminal as well as during the ship’s voyage. It is also possible that your cargo has been misplaced, damaged or lost. Marine cargo insurance is offered in exchange for an adequate premium payment, to safeguard the cargo owner from financial damages resulting from such incidents. It includes third-party liability insurance, which covers any damage caused by your cargo to the port, ship, railway track, other cargo, or individuals.

2. Hull & machinery insurance

Without masts, the hull is the main supporting structure on a vessel. Thus, hull insurance protects the insured in the event of a ship disaster. It is commonly used by ship owners. Along with hull insurance, machinery insurance should be purchased to cover the ship’s machinery. It protects the insured against operational, mechanical, and electrical ship machinery damage. Because both portions cover the entire ship, the insurance provider issues it as Hull and Machinery Insurance.

3. Liability insurance

The ship could be involved in a collision, crash or piracy attack. In such cases, the valuable cargo is put at great risk. Furthermore, the lives of crew members and others on the ship are in jeopardy. The appropriate liability insurance protects the ship owner from any such obligations caused by situations beyond his control.

4. Freight insurance

This section addresses the loss of freight. If the goods are lost or damaged, or the ship is lost, the shipping business will not be held liable. This insurance can compensate them for their loss.

What is Marine Insurance? Why is Marine Insurance important for Businesses?

Business items are the source of revenue for most businesses. Insuring them against any untoward incident while they are being transported helps secure the fortunes of your business. The importance of this policy cannot be overstated. Business shipments are typically high in value and any damage can impact the company directly. You are probably worried about plenty of things already if you are making a move for personal or professional reasons. Knowing that all your household items are safe means that you can breathe easy about this thing at least.

Marine Insurance stands as a cornerstone of the shipping industry and international trade, offering indispensable protection and facilitating smooth operations. Here are some key reasons highlighting the importance of Marine Insurance:

- Protection against Loss:

Marine Insurance shields against potential losses incurred during transit, including theft, damage, or loss of cargo, vessels, or equipment. Given the substantial financial repercussions of such occurrences, Marine Insurance plays a pivotal role in mitigating financial impact and ensuring business continuity for all parties involved. - Compliance with Legal Requirements:

Many countries mandate vessels and shippers to possess marine cargo insurance coverage to adhere to regulatory frameworks. For instance, in India, valid marine cargo insurance coverage is a prerequisite for all vessels transporting cargo, ensuring adherence to legal obligations and regulatory standards. - Risk Management:

The shipping industry is inherently exposed to various risks, ranging from natural disasters to piracy and accidents. Marine Insurance empowers shipowners and cargo owners to effectively manage these risks, providing a safety net against potential financial losses arising from unforeseen events. - Facilitation of International Trade:

Marine Insurance plays a pivotal role in fostering international trade by instilling confidence among buyers and sellers regarding the protection of their cargo during transit. This assurance contributes to the smooth flow of trade, bolstering trade volumes, and enhancing profitability in the global marketplace. - Encouragement of Investment:

By mitigating risks associated with ship ownership, operation, and investment, Marine Insurance serves as a catalyst for increased investment in the shipping industry. This protection fosters a conducive environment for investment, leading to enhanced efficiency, modernization, and growth within the industry.

In essence, Marine Insurance serves as a vital safeguard for stakeholders in the shipping industry, offering peace of mind, regulatory compliance, risk mitigation, and facilitating seamless international trade and investment. Its significance cannot be overstated in ensuring the resilience and prosperity of the maritime sector on a global scale.

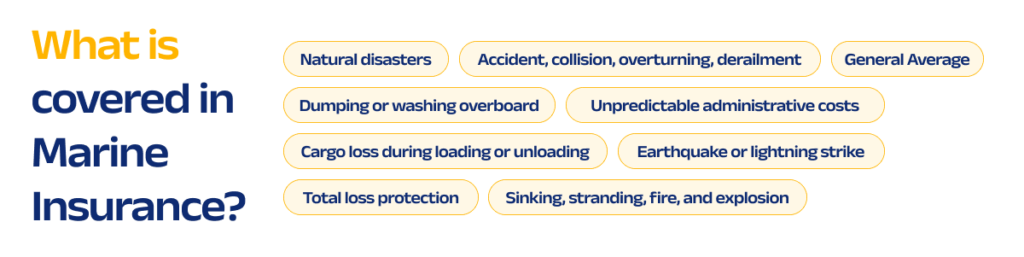

What is Marine Insurance? What is covered in it?

- Total loss protection

- Sinking, stranding, fire, and explosion

- Earthquake or lightning strike

- Unpredictable administrative costs

- Cargo loss during loading or unloading

- Dumping or washing overboard

- Natural disasters

- Accident, collision, overturning, derailment

- Average in general

What all are not covered by Marine Insurance?

- The insured committed a willful act.

- Liquid leakage, normal weight loss or volume loss, or normal wear and tear of the insured item.

- Packing is inadequate or unsuitable.

- The subject matter insured has a vice or nature inherent in it.

- Delay of goods

- Owners, managers, charterers, or operators of the vessel defaulting on their financial obligations.

- Unsuitability/unseaworthiness of the conveyance

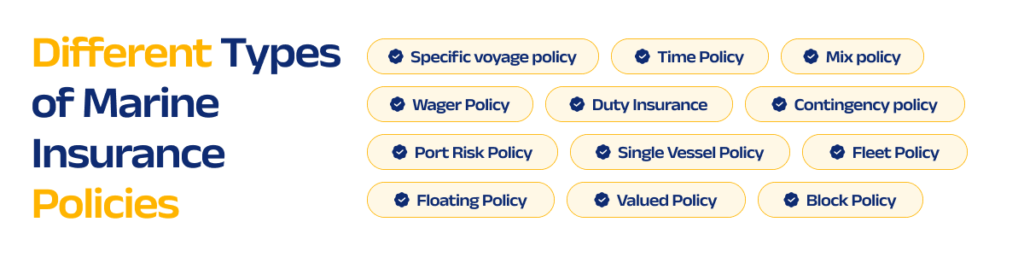

Different Types of Marine Insurance Policies –

1. Specific voyage policy: This policy caters to goods transported through inland transport.

2. Time Policy: Generally, a time policy covers a fixed period, such as a year.

3. Mix policy- Such a Marine Insurance Policy extends insurance coverage for a specific voyage and for the chosen length of time. It allows clients the flexibility to handle numerous uncertainties associated with the movement of the ship and the cargo inside the ship.

4. Wager Policy: If the insurance company determines that the damage is worth the claim, reimbursements are provided; otherwise, there is no compensation offered. There are no fixed conditions for reimbursements in a wager policy. The wager policy is not a written insurance policy, so it is not valid in a court of law.

5. Duty Insurance: According to the Customs Act, cargo imported into India must be insured against Customs Duty. An insurance policy can include this duty in the value of the cargo insured, or it can be issued separately, with the Duty Insurance Clause incorporated into the policy.

6. Contingency policy: If the policyholder is not required to insure under the Terms of Sale or where the cover provided is more restrictive than that offered under this policy, this policy extends to cover the contingent financial interest of the policyholder.

7. Port Risk Policy: Marine Insurance Policies like this one are taken out to ensure the ship’s safety while in port.

8. Single Vessel Policy: Small shipowners can use this policy if they have one ship, or if they have one ship in several fleets. It covers the risk of one vessel for the insured.

9. Fleet Policy: Several ships owned by one owner are covered under this policy.

10. Block Policy: Cargo owners are protected by this policy against damage or loss of cargo through all modes of transportation in which their cargo is transported, including rail, road, and sea.

11. Floating Policy: The shipping line is issued a floating policy on a continuous basis. The only detail stated in the policy is the maximum sum insured. When the ship starts to sail, the insurance company is informed of all additional facts. This is the best approach for regular cargo owners who require frequent transportation of goods via shipping line, in order to save time and money.

12. Valued Policy: Valued Marine Insurance Policies are the opposite of Open Marine Insurance Policies. The value of the cargo and consignment is determined in the policy document beforehand, so it is clear about the amount of reimbursement if there is a loss of cargo or consignment.

What is Marine Insurance? How Does Marine Insurance Work?

A Marine Insurance Policy transfers the liability of the goods from the parties and associated intermediaries to the insurance provider. The legal liability of those handling the goods is limited from the outset. To protect the exported goods against loss or damage, the exporter can purchase an insurance policy that covers the goods against any possible loss or damage.

If there is damage or loss to the goods while on board, the carrier may be held responsible, though most compensation is on a ‘per package’ or ‘per consignment basis. In this case, the insurance coverage may not be sufficient to cover the cost of the goods shipped. For this reason, exporters prefer to ship their products after they have been insured by an insurance company.

Marine Insurance is necessary to fulfil export contract obligations. To align with agreements such as Cost Insurance And Freight (CIF) or Carriage And Insurance Paid (CIP), the exporter must take Marine Insurance to protect their bank or buyer interests and fulfil their contractual obligations. The seller does not have to insure goods under Delivered Duty Unpaid (DDU) and Delivered Duty Paid (DDP) terms, but in practice they generally do.

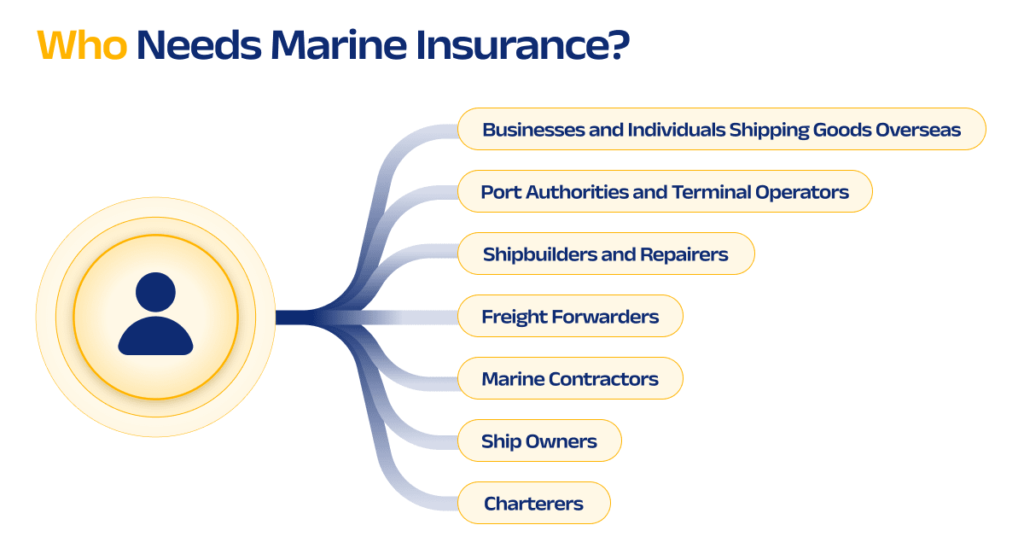

Who Needs Marine Insurance?

Marine Insurance is vital for a diverse array of individuals and businesses involved in maritime activities. Here are some key stakeholders who require Marine Insurance:

- Ship Owners:

Ship owners rely on Marine Insurance to safeguard their vessels against various risks, including damage, loss, and liability claims. Vessel coverage ensures financial protection and operational continuity for ship owners. - Freight Forwarders:

Freight forwarders play a crucial role in arranging the transportation of goods and ensuring their safe delivery. Marine Insurance is essential for freight forwarders to mitigate risks associated with cargo loss or damage during transit. - Businesses and Individuals Shipping Goods Overseas:

Businesses and individuals engaged in international trade depend on Marine Insurance to protect their cargo during transportation. Coverage extends to risks such as theft, piracy, natural disasters, ensuring financial security for shippers. - Shipbuilders and Repairers:

Shipbuilders and repairers require Marine Insurance to mitigate risks associated with ship construction, repair, and maintenance. Coverage encompasses damage to vessels within shipyards and liability claims from third parties. - Port Authorities and Terminal Operators:

Port authorities and terminal operators are responsible for the safe handling of cargo and vessels within ports. Marine insurance is crucial to protect against damage, loss, or liability claims arising from port activities. - Marine Contractors:

Marine contractors involved in offshore activities, such as oil and gas exploration, rely on Marine Insurance to manage risks associated with their operations. Coverage includes protection against equipment damage, personnel injury, and environmental pollution. - Charterers:

Charterers lease ships for specific periods and assume responsibility for vessel operation during the charter period. Marine insurance is essential for charterers to mitigate losses or damages that may occur while the vessel is under their control.

In conclusion, Marine Insurance is indispensable for a wide range of stakeholders involved in maritime activities, providing comprehensive coverage tailored to their specific needs and risks. Whether it’s protecting vessels, cargo, or maritime operations, Marine Insurance plays a pivotal role in ensuring financial security and risk management within the maritime industry.

Types of Marine Insurance Policies:

- Marine Open Cover:

Open Cover Policies are prevalent in international trade, especially among companies engaged in high-volume transactions over extended periods. This type of coverage eliminates the need to negotiate terms for each shipment separately. Typically issued for one year, open covers establish an agreement to insure shipments by sea or air between specified terminals or on a global scale.

- Marine Open Policy:

Large commercial enterprises with significant trade volumes and numerous transactions may find it cumbersome to insure individual transits separately. Open policies offer a convenient and efficient method of providing automatic protection for all consignments of such insured entities. These policies, issued for one year in proper policy form, represent an aggregate sum insured for dispatches expected during the policy period. Premiums are collected in advance, and declarations of transits made by the insured are recorded and accounted for, thereby adjusting the estimated sum insured under the policy.

Open policies are commonly used to cover domestic dispatches by rail, road, air, or registered post, subject to a maximum value limit per sending or dispatch. The policy ceases to operate upon the expiry of the policy period or upon exhaustion of the sum insured, whichever occurs earlier. Therefore, insured parties must ensure that the sum insured is replenished with additional premium if there is a possibility of depletion before the policy’s expiry.

- Specific Voyage Policy:

This policy applies to a single voyage or transit and must be obtained before the voyage commences. Coverage terminates immediately upon completion of the voyage. The specific voyage policy should provide comprehensive details of the risk, including particulars of the conveyance, vessel name, bill of lading, air waybill, consignment note, sum insured, terms and conditions of cover, voyage, cargo description, etc.

Please note that the coverage, liabilities, and exclusions mentioned above are not exhaustive. For complete details, individuals can reach out to their nearest branch office.

History of Marine Insurance (Global)

In December 1901 and January 1902, under the direction of archaeologist Jacques de Morgan, Father Jean-Vincent Scheil, OP discovered a significant artifact: a 2.25-meter tall basalt or diorite stele, divided into three pieces, inscribed with 4,130 lines of cuneiform law attributed to Hammurabi (c. 1792–1750 BC) of the First Babylonian Empire. This remarkable find occurred in the city of Shush, Iran.

Among the laws inscribed on the stele, several pertain to shipping and maritime commerce. For instance, Law 100 stipulated the repayment terms for debtors, while Laws 101 and 102 outlined conditions for repayment in the event of net income loss or total loss due to unforeseen circumstances. Law 103 provided relief for agents, factors, or charterers in cases of theft, upon provision of an affidavit to their creditor.

Further laws addressed various aspects of maritime commerce, including contracts of carriage, liabilities of carriers, and obligations of shipbuilders and sea captains. Law 104 mandated the issuance of waybills and invoices for contracts of carriage, while Law 105 established requirements for claims filed by agents, factors, and charterers.

In addition to the ancient laws of Hammurabi, the Digesta seu Pandectae, compiled in 533 AD as part of the codification of laws ordered by Justinian I of the Eastern Roman Empire, included legal opinions on the Lex Rhodia (Rhodian law). This law, dating back to approximately 1000–800 BC, established the principle of general average in Maritime Insurance, emphasizing risk-sharing among shipowners and cargo owners.

The evolution of Marine Insurance continued over the centuries, with separate Marine Insurance contracts emerging in medieval times. By the 14th century, Marine Insurance had gained prominence in Italian cities such as Genoa and Camogli, before spreading to northern Europe.

In England, the establishment of a specialized chamber of assurance in 1601 marked the formalization of Marine Insurance as a distinct area of law. Edward Lloyd’s coffee house in London became a renowned meeting place for ship owners, merchants, and underwriters, laying the foundation for the establishment of Lloyd’s of London, the world’s first Marine Insurance market.

Over time, standardized policies and judicial precedent further developed Marine Insurance law, culminating in the Marine Insurance Act of 1906, which codified common law principles and remains a cornerstone of insurance legislation.

Today, Marine Insurance remains a vital component of the global insurance industry, covering risks associated with hulls, cargo, and liabilities. The Nordic region, China, and Lloyd’s of London are among the leading providers of marine hull insurance, reflecting the continued importance of maritime commerce in the modern era.

Specialist Marine Insurance agencies play a crucial role in providing coverage for unique or challenging risks that may not be readily available from traditional insurers. These agencies, often independent of insurers, contribute to market liquidity and innovation in Marine Insurance.

In conclusion, the history of shipping and Marine Insurance spans millennia, from the ancient laws of Hammurabi to the modern global insurance market. Through adaptation and innovation, Marine Insurance continues to protect the interests of shipowners, cargo owners, and other stakeholders in maritime commerce.

Document Required When Purchasing Marine Insurance

- Customer’s Name

- Pick-up and Drop-off Locations along with Pincode

- Copy of the Bill or LR (Lorry Receipt) provided by the Transporter

- PAN (Permanent Account Number) and Aadhar card for KYC (Know Your Customer) purposes

- Sum insured value based on the estimated cost of goods.

How Marine Cargo Insurance Works?

Marine Cargo Insurance serves as a crucial safeguard for cargo owners and shippers, offering protection against the myriad risks involved in transporting goods by sea, air, or land. Here’s an overview of how marine cargo insurance operates:

- Procurement of Insurance:

Before shipping the cargo, the cargo owner or shipper can secure marine cargo insurance from an insurance company. The policy can be customized to align with the specific requirements of the cargo owner, considering factors such as the nature of the cargo, mode of transportation, value of the goods, and destination. - Coverage Scope:

Marine cargo insurance typically encompasses protection against various perils that may result in loss or damage to the cargo during transit. These risks include natural disasters like storms, lightning, earthquakes, as well as man-made hazards such as theft, fire, and piracy. Additionally, coverage may extend to losses arising from improper handling, packaging, or carrier errors or omissions. - Premium Determination:

The premium for the insurance policy is calculated based on factors such as the value of the cargo, the level of risk involved in the transportation, the chosen mode of conveyance, and other relevant considerations. The cargo owner or shipper pays the premium to the insurance company to activate the coverage. - Claims Process:

In the event of loss or damage to the cargo during transit, the cargo owner or shipper can initiate a claim with the insurance company. Supporting documentation, such as bills of lading, cargo receipts, or other relevant records, should accompany the claim to substantiate the loss or damage incurred. - Claim Settlement:

Upon receiving the claim, the insurance company conducts an investigation to assess the extent of the loss or damage and determine the compensation owed to the cargo owner or shipper. The settlement amount is typically calculated based on the value of the cargo and the severity of the loss or damage. Once finalized, the insurance company disburses the settlement amount to the cargo owner or shipper, providing financial relief for the incurred losses.

Marine cargo insurance plays a vital role in safeguarding the interests of cargo owners and shippers in India, offering indispensable financial protection against the inherent risks of transportation. By securing a comprehensive marine cargo insurance policy, cargo stakeholders can navigate the complexities of transit with confidence, knowing that they are adequately covered in case of unforeseen contingencies.

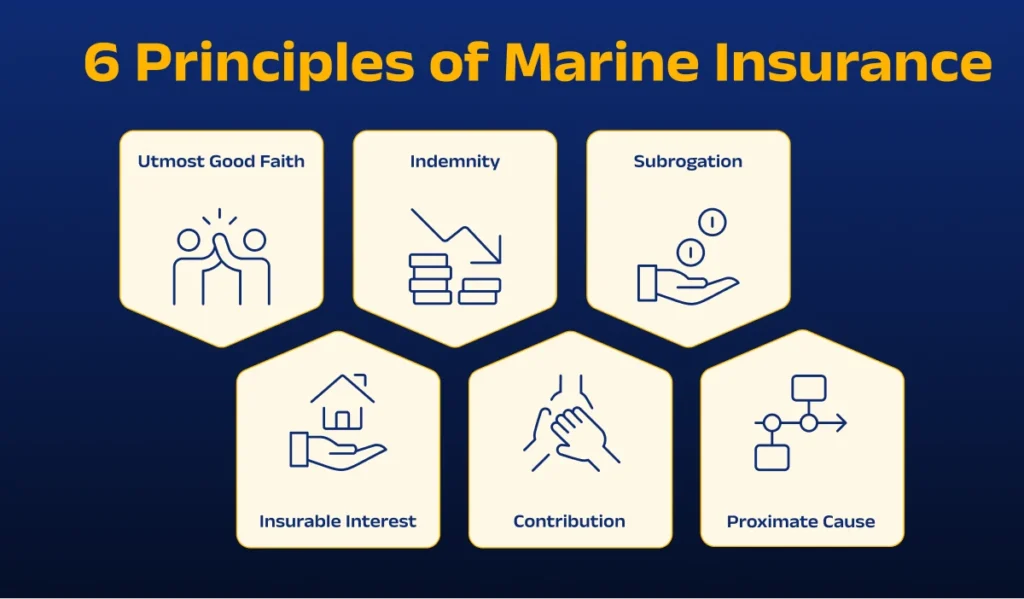

Principles of Marine Insurance

The principles of Marine Insurance serve as foundational guidelines governing the application and operation of Marine Insurance Policies. These principles ensure fairness and effectiveness in managing maritime risks. Key principles include:

- Utmost Good Faith: Both the insured and insurer are bound by a duty of absolute honesty, requiring full and accurate disclosure of all relevant information related to the insured risk to form a valid contract.

- Insurable Interest: The insured must possess a legitimate financial interest in the cargo or property insured. Without insurable interest, the insurance contract is void.

- Indemnity: Marine Insurance aims to provide financial compensation (indemnity) to the insured in case of covered loss or damage. The payout aims to restore the insured to their pre-loss financial position without allowing for profit.

- Proximate Cause: In the event of multiple causes contributing to a loss or damage, the proximate cause, i.e., the most direct or dominant cause, determines the coverage under the insurance policy.

- Subrogation: Upon compensating the insured, the insurer may assume the insured’s rights to pursue legal action against third parties responsible for the loss. This principle enables the insurer to recover the paid claim amount.

- Contribution: When a risk is covered by multiple insurance policies, the principle of contribution applies. Each insurer shares the cost of the claim proportionally based on the limits and conditions of their respective policies.

Conclusion

We hope from the discussion above, you have got a fair idea of Marine Insurance, what it includes, and other related topics. Click here to read about Fire Insurance.

Frequently Asked Questions

1. What is the period of Marine Insurance?

A Marine Insurance Policy covers the normal time taken for a transit, usually no more than one year.

2. How is the Marine Insurance Policy premium charged?

The owner is responsible for paying the premiums well in advance so that the risk can be covered.

3. Is insurable interest mandatory in Marine Insurance Policy?

Yes, it is required in all insurance policies including Marine Insurance. An insured person will be eligible for Marine Insurance if he has an insurable interest at the time of the loss.